Calculate loan payment student: Delve into a comprehensive guide that deciphers the complexities of student loans, empowering you with the knowledge to calculate your payments, explore repayment strategies, and navigate the path to financial freedom.

The intricacies of student loans can be daunting, but with the right tools and understanding, you can take control of your financial future. This guide will provide you with the knowledge and resources you need to calculate your student loan payments, explore repayment strategies, and understand the factors that affect your monthly payments.

Calculate Student Loan Payment: Calculate Loan Payment Student

Student loans can be a significant financial burden, but there are ways to make them more manageable. One important step is to understand the different types of student loans and their repayment options.

Types of Student Loans

- Federal student loans are provided by the U.S. government and offer a variety of repayment options.

- Private student loans are provided by banks and other lenders and typically have higher interest rates and fewer repayment options.

Repayment Options

There are several different repayment options available for student loans, including:

- Standard repayment: This is the most common repayment option, and it involves making fixed monthly payments over a period of 10 years.

- Graduated repayment: This option starts with lower monthly payments that gradually increase over time.

- Extended repayment: This option allows borrowers to extend the repayment period to up to 25 years.

- Income-driven repayment: This option bases monthly payments on the borrower’s income and family size.

Student Loan Repayment Calculator

Student loan debt is a significant financial burden for many Americans. A student loan repayment calculator can help you estimate your monthly payments and plan for repayment.

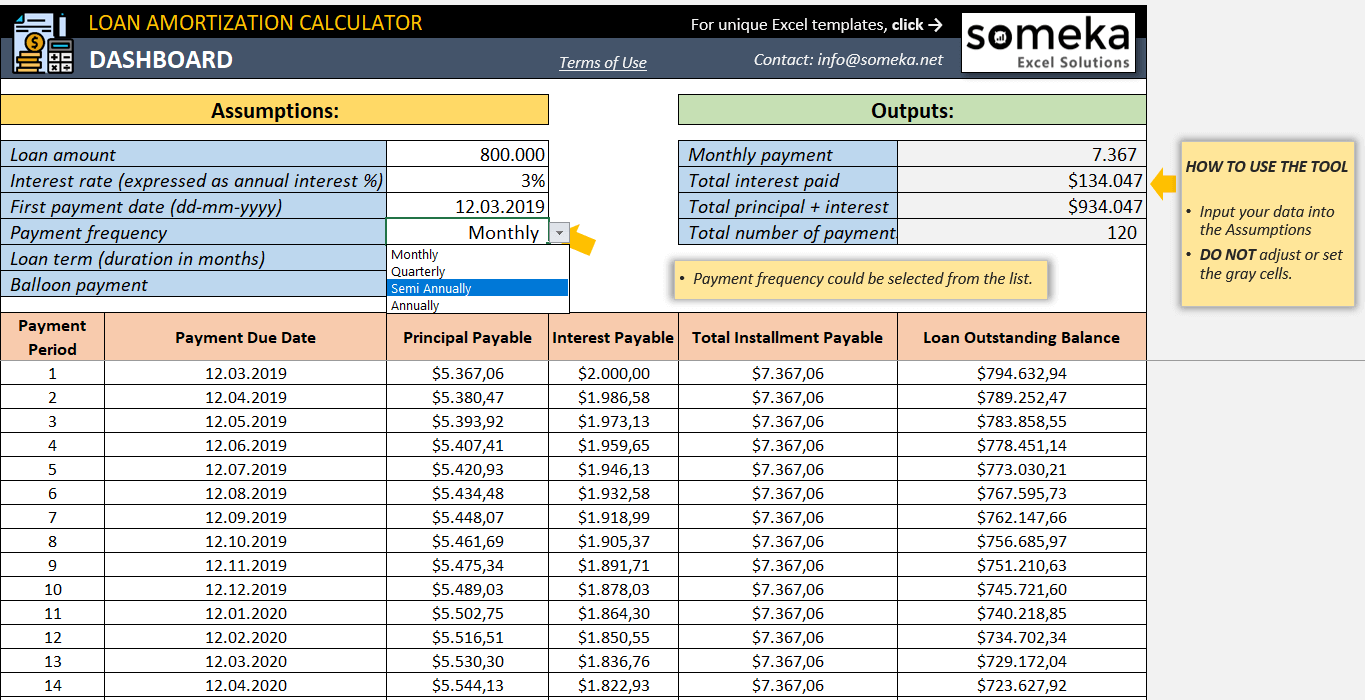

A student loan repayment calculator is a tool that allows you to input your loan details and calculate your monthly payments. The calculator will typically ask for the following information:

- Loan amount

- Interest rate

- Loan term

Once you have entered your information, the calculator will calculate your monthly payment. You can then use this information to budget for repayment and explore different repayment options.

Additional Features

In addition to calculating your monthly payment, a student loan repayment calculator may also offer other features, such as:

- The ability to compare different repayment options

- An estimate of the total cost of your loan

- A payment schedule that shows how your payments will be applied to your loan balance

These additional features can help you make informed decisions about your student loan repayment.

Factors Affecting Student Loan Payments

Student loan payments are calculated based on several key factors that determine the monthly amount borrowers must pay. Understanding these factors can help borrowers make informed decisions about their loans and potentially reduce their monthly payments.

Loan Amount

The loan amount, or the total amount borrowed, directly impacts the monthly payment. A higher loan amount results in a higher monthly payment, as the borrower must repay the principal (the original amount borrowed) plus interest over the loan term.

For example, a borrower with a $100,000 loan at a 5% interest rate will have a higher monthly payment than a borrower with a $50,000 loan at the same interest rate.

Interest Rate

The interest rate is the percentage charged on the loan balance. A higher interest rate leads to a higher monthly payment, as more of the payment goes towards interest rather than principal. Conversely, a lower interest rate results in a lower monthly payment.

For instance, a borrower with a $100,000 loan at a 10% interest rate will have a higher monthly payment than a borrower with the same loan amount at a 5% interest rate.

Loan Term, Calculate loan payment student

The loan term, or the length of time the borrower has to repay the loan, also affects the monthly payment. A shorter loan term typically results in a higher monthly payment, as the borrower has less time to repay the loan and the interest accrues over a shorter period.

On the other hand, a longer loan term leads to a lower monthly payment, as the borrower has more time to repay the loan and the interest is spread out over a longer period. For example, a borrower with a $100,000 loan at a 5% interest rate with a 10-year term will have a higher monthly payment than a borrower with the same loan amount and interest rate but a 20-year term.

Adjusting Factors to Reduce Payments

Borrowers can adjust these factors to reduce their monthly payments. Refinancing the loan to a lower interest rate or extending the loan term can result in a lower monthly payment. Additionally, making extra payments towards the principal can help reduce the loan balance faster, leading to lower interest charges and a shorter loan term, ultimately reducing the overall cost of the loan.

Student Loan Repayment Strategies

Managing student loan debt can be a daunting task, but choosing the right repayment strategy can make a significant difference in the total cost and duration of your loan. Here are the key strategies to consider:

Standard Repayment Plan

The standard repayment plan is the most straightforward option, with fixed monthly payments over a 10-year period. This plan typically results in the lowest total interest paid compared to other repayment options.

Students considering higher education should be aware of the potential financial burden they may face. To make informed decisions about borrowing, it’s crucial to calculate loan payment student obligations accurately. By estimating monthly payments, students can assess their financial preparedness and explore alternative funding options.

Graduated Repayment Plan

The graduated repayment plan offers lower monthly payments initially, which gradually increase over the repayment period, usually 10 years. While this plan can provide some initial financial relief, it ultimately results in higher total interest paid compared to the standard repayment plan.

Extended Repayment Plan

The extended repayment plan extends the repayment period to 20 or 25 years, resulting in lower monthly payments but significantly higher total interest paid over the life of the loan. This option may be suitable for borrowers with high loan balances or those struggling to make payments under the standard or graduated repayment plans.

If you’re considering taking out student loans, it’s important to have a clear understanding of how much your monthly payments will be. There are a number of factors that can affect your loan payment, including the amount you borrow, the interest rate, and the repayment period.

You can use a student loan calculator to estimate your monthly payments before you apply for a loan. This can help you make an informed decision about how much you can afford to borrow and what repayment options are available to you.

Calculate your student loan payment to get a better understanding of your repayment options.

Student Loan Forgiveness Programs

Student loan forgiveness programs offer a glimmer of hope for borrowers struggling to repay their student debt. These programs provide opportunities for borrowers to have their federal student loans forgiven after a certain period of time or under specific circumstances.

One of the most well-known student loan forgiveness programs is Public Service Loan Forgiveness (PSLF). PSLF is designed to encourage individuals to work in public service by forgiving their student loans after they have made 120 qualifying payments while working full-time for a qualifying employer.

Teacher Loan Forgiveness

Teacher Loan Forgiveness is another popular student loan forgiveness program. This program forgives up to $17,500 in federal student loans for teachers who have taught for five consecutive years in a low-income school or educational service agency.

To apply for student loan forgiveness, borrowers must first submit an application to the Department of Education. The application process can be complex, so it is important to carefully review the requirements and follow the instructions provided by the Department of Education.

Here are some tips for borrowers who are interested in applying for student loan forgiveness:

- Make sure you meet the eligibility requirements for the program you are applying for.

- Gather all of the required documentation before you apply.

- Follow the instructions on the application carefully.

- Submit your application on time.

- Be patient. The application process can take several months.

Epilogue

Empower yourself with the knowledge to calculate student loan payments, explore repayment strategies, and navigate the path to financial freedom. This guide has provided you with the tools and understanding you need to take control of your student loans and achieve your financial goals.

Helpful Answers

What is the difference between subsidized and unsubsidized student loans?

Subsidized student loans are loans for which the government pays the interest while you are in school and during periods of deferment. Unsubsidized student loans are loans for which you are responsible for paying the interest at all times.

How can I reduce my student loan payments?

There are several ways to reduce your student loan payments, including: making extra payments, refinancing your loans, or applying for a loan forgiveness program.

What is the Public Service Loan Forgiveness Program?

The Public Service Loan Forgiveness Program is a program that forgives the remaining balance of your student loans after you have made 120 qualifying payments while working full-time for a public service organization.